michigan gas tax rate

Gas Tax rate can vary from 283-363 cpg depending on area Other Taxes include 2071 USTInspection fee diesel 125 cpg state sales tax 2196 USTInspection fee gasoline. For general questions please email.

Snyder Signs Road Bills That Hike Gas Tax Fees Crain S Detroit Business

This article focuses.

. So far in 2021 inflation has been unusually high. The fuel may be returned to the supplier. The change comes as the national average price for a gallon of gasoline has topped 5 for the first time and experts warn we could see 6 by Labor Day.

In the United States the federal motor fuel tax rates are. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

Michigan drivers were taxed 641 cents per gallon of gasoline in January 2022 the sixth-highest gas tax in the nation. The Michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states. Gas tax is different for gasoline diesel aviation fuel and jet fuel.

Michigan natural gas rates. How a rate review works. The current federal motor fuel tax rates are.

The proposal is split into four bills that would enact tax suspensions from June 15 through Sept. Use the Michigan Gas Tax Calculator by the Michigan Petroleum Association to caluclate the fuel taxes you pay. 0194gallon and jet fuel tax.

US Fuel Tax State Map. MoreMichigan Legislatures new 25B plan reduces income tax creates 500 child tax credit MoreMichigan Senate approves proposal that would pause taxes on gas this summer Republicans blasted. Ever wondered how much of your Gas purchase at the pump goes to Taxes.

Natural gas prices as filed with the Michigan Public Service Commission. Canada Fuel Tax Rates. When the gas tax increase kicks in just months from now Michigan residents will find themselves paying as much as 14 cents more per gallon.

The same three taxes are included in the retail price on. What is in a Barrel of Crude. Call center services are available from 800am to 445PM Monday Friday.

2 days agoDemocratic Governor Gretchen Whitmer vetoed a bill Friday that was sent to her by the GOP-controlled Legislature to reduce the states income tax rate. Prepaid rate on gasoline is 17. Michigan Gas Tax 17th highest gas tax.

She said the bill was fiscally irresponsible compared to other options to help families deal with fuel costs and rampant inflation. Pursuant to MCL 2056a a taxpayer may rely on a Revenue Administrative Bulletin issued by the Department of Treasury after September 30 2006 and shall not be penalized for that reliance until the bulletin. Motor Fuel Taxes In Michigan three taxes are included in the retail price of gasoline.

A gas tax or fuel tax is an excise tax imposed on the sale of fuel. And the states gas tax as a share of the total. Federal excise tax rates on various motor fuel products are as follows.

Motor Fuel Tax The state of Michigan imposes a 19-cent per gallon excise tax on gasoline used in motor vehicles. It would also set aside 300 million total for county road commissions cities and villages to account for projected lost revenue. That includes a roughly 1.

The Michigan gas tax is included in the pump price at all gas stations in Michigan. Victorys bill SB 1029 would temporarily set Michigans per-gallon motor fuel tax rate at zero cents. As of January of this year the average price of a gallon of gasoline in Michigan was 237.

6 Other Taxes 0875 cpg for environmental regulation fee Diesel Tax rate is rate 6 local sales tax. Michigans excise tax on gasoline is ranked 17 out of the 50 states. Starting in July the optional standard.

0183 per gallon. GOP outraged as Whitmer rejects gas tax holiday Michigan income tax cut March 11. Michigan Gas Choice allows you to choose your natural gas supplier from participating suppliers.

0244gallon aviation fuel tax. Liquefied Natural Gas LNG 0243 per gallon. 1 2020 and Sept.

Gas Price Heat Map. The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon. The exact amount of the 2022 increase will depend on the inflation that occurs between Oct.

Michigan House lawmakers approved a Republican. US Fuel Tax Rates. Most jet fuel that is used in commercial transportation is 044gallon.

LANSING MI Michigan senators on Tuesday approved a six-month suspension to the states 27-cent-per-gallon gas tax. The proposal HB 5570 would eliminate the motor fuel tax beginning April. A refund for the Michigan motor fuel tax is provided for in Section 40 of the Act 403 unless an insurance company reimburses the cost of the tax loss.

In Michigan were paying some of the highest taxes per gallon in the nation and todays rate is because of a tax signed into law in 2015. This tax is established in the Motor Fuel Tax Act 2000 PA 403. For fuel purchased January 1 2017 and through December 31 2021.

Crude Oil Price Chart. COVID-19 Updates for Michigan Motor Fuel Tax Motor Fuel Tax Return filing deadlines have not changed. Mar 25 2020.

Whitmer signals likely veto on Michigan gas tax holiday LANSINGAs gasoline prices hit record highs nationwide Michigan leaders are pushing for gasoline tax relief but differ on how the state should offer it. Information on natural gas service and rates for residential customers in Michigan. June 1 2022 Replaces Administrative Bulletin 2022-7.

The veto was no surprise since Whitmer rejected a similar. Nationwide the price of regular gasoline on average hit. NOTICE OF PREPAID SALES TAX RATES ON FUEL IN EFFECT FOR THE MONTH OF JULY 2022.

These taxes are included in the price of fuel purchased at the pump This memo provides background information on taxes imposed on motor fuels in Michigan. 52 rows Federal Motor Fuel Taxes. MiMATS users should continue to use the MiMATS eServices portal.

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Michigan Gas Tax Vehicle Registration Fees To Increase Jan 1

What Is The Gas Tax Rate Per Gallon In Your State Itep

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

Michigan Gasoline And Fuel Taxes For 2022

Fuel Tax Rate Changes In Effect Jan 1 Land Line

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Michigan Senate Passes Fuel Tax Pause Bills

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Michigan Gasoline And Fuel Taxes For 2022

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

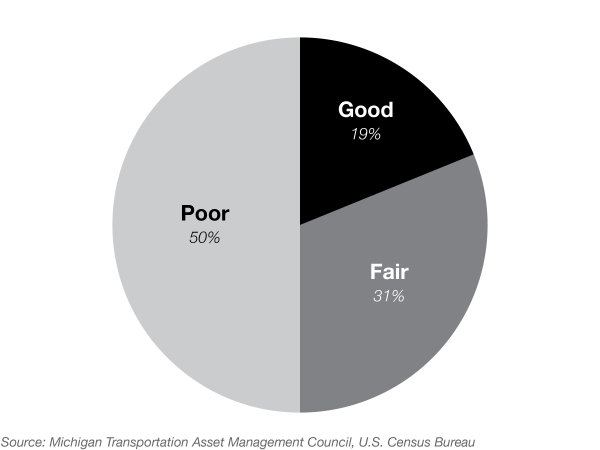

How Road Funding Works In Michigan Roads In Michigan Quality Funding And Recommendations Mackinac Center

Motor Fuel Taxes Urban Institute

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Coronavirus Greater West Bloomfield Civic Center Tv

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center